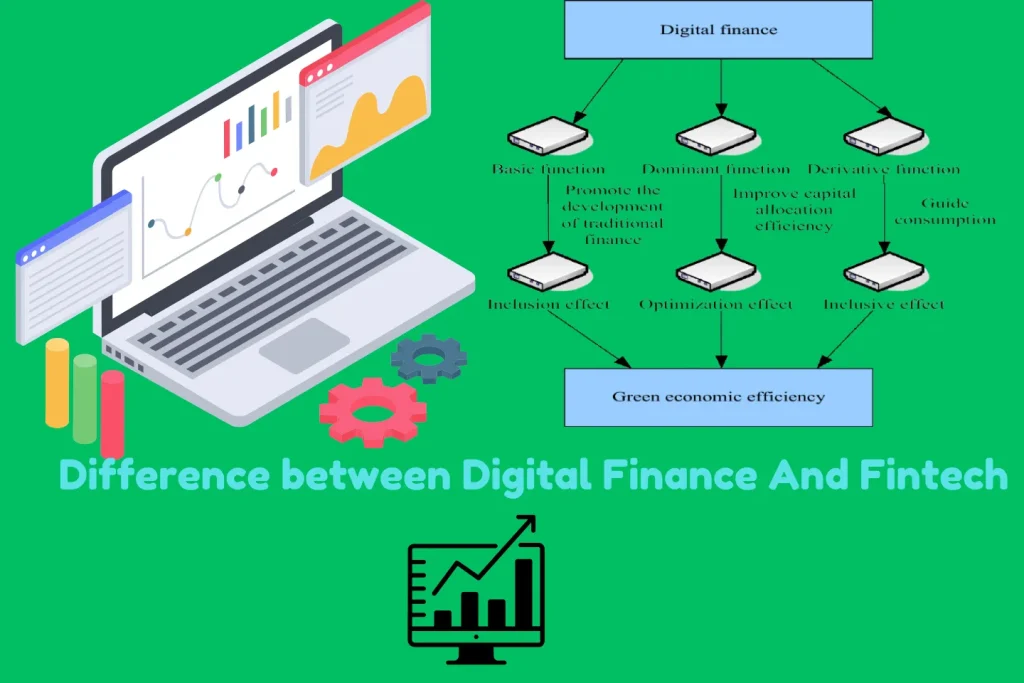

The difference between digital finance and fintech can be confusing. Both terms often overlap, yet they have distinct meanings.

Digital finance refers to the broad use of digital technology in financial services. It includes everything from online banking to mobile payments. Fintech, on the other hand, is a subset of digital finance. It focuses on innovative technologies and startups aiming to improve financial services.

Comparing these concepts helps clarify their unique roles in the financial world. Knowing the difference can guide better decisions in both personal and business finance. Let’s explore how digital finance and fintech differ and how each impacts our daily financial activities.

Introduction To Digital Finance

Digital finance is transforming the way we handle money. It blends finance with technology, offering seamless financial services. From online banking to mobile payments, digital finance is everywhere.

Definition Of Digital Finance

Digital finance refers to the digitalization of financial services. This includes banking, investments, and payments through digital platforms. It simplifies financial transactions and makes them more accessible. Digital finance uses the internet, mobile devices, and cloud computing. These tools enhance user experience and efficiency.

Key Components Of Digital Finance

Several key components make up digital finance. These include:

- Online Banking: Access your bank account online. Transfer money, check balances, and pay bills from your device.

- Mobile Payments: Use your smartphone to pay for goods and services. Examples include Apple Pay and Google Wallet.

- Cryptocurrencies: Digital or virtual currencies. Bitcoin is a popular example.

- Digital Wallets: Store your payment information securely. Examples include PayPal and Venmo.

- Peer-to-Peer Lending: Borrow and lend money without a bank. Platforms like LendingClub facilitate this.

- Robo-Advisors: Automated financial advice. These tools help manage investments based on algorithms.

Digital finance is reshaping the financial landscape. It offers convenience, speed, and efficiency.

Credit: www.differencebetween.net

Introduction To Fintech

Fintech has become a popular term. It combines finance and technology. But what exactly is Fintech? Let’s explore this fascinating field.

Definition Of Fintech

Fintech stands for financial technology. It refers to new tech that improves and automates financial services. This includes software, algorithms, and applications for financial tasks. These technologies aim to make financial services more efficient and accessible.

Key Components Of Fintech

Several components make up the Fintech ecosystem. Below are the most important ones:

| Component | Description |

|---|---|

| Payments | Technologies that facilitate online transactions. |

| Blockchain | A system for secure and transparent transactions. |

| Robo-Advisors | Automated platforms for financial advice and management. |

| Insurance | Innovative solutions in the insurance industry. |

| Regtech | Technologies that help companies comply with regulations. |

These components work together to transform the financial industry. They make services faster, cheaper, and more user-friendly.

Historical Background

The terms Digital Finance and Fintech often seem synonymous. Yet, they have distinct historical backgrounds. Understanding their evolution helps them grasp their current roles and future potential. Let’s delve into the historical development of both.

Evolution Of Digital Finance

Digital Finance started in the late 20th century. It emerged with the advent of computers and the internet. Banks began using digital systems for transactions and record-keeping. These systems replaced manual bookkeeping.

In the 1980s, the first Automated Teller Machines (ATMs) appeared. Customers could now access cash anytime. Online banking followed in the 1990s. This allowed users to manage accounts from their homes.

Digital finance tools expanded. They now include mobile banking, digital wallets, and online investment platforms. These tools offer convenience and speed. They change how people manage money daily.

Evolution Of Fintech

Fintech, short for Financial Technology, has a more recent history. It gained momentum in the 21st century. Early fintech innovations focused on backend systems for banks and trading firms. These systems streamlined processes and reduced costs.

After the 2008 financial crisis, fintech saw a surge. Startups began offering alternative financial services. Peer-to-peer lending and crowdfunding platforms became popular. These services provided new ways to borrow and invest money.

Today, fintech encompasses a wide range of technologies. It includes blockchain, robo-advisors, and payment apps. These technologies disrupt traditional finance models. They create new opportunities and challenges in the financial sector.

Core Technologies

The world of finance is evolving rapidly. Central to this evolution are the core technologies driving digital finance and fintech. These technologies shape the future of how we manage, invest, and use money. Understanding the differences helps in grasping their unique benefits and applications.

Technologies In Digital Finance

Digital finance relies on several key technologies to enhance traditional financial services. These include:

- Internet Banking: Allows customers to perform financial transactions online.

- Mobile Banking: Provides banking services through mobile apps.

- Automated Teller Machines (ATMs): Offers 24/7 access to cash and other services.

- Credit and Debit Cards: Facilitates cashless transactions globally.

- Electronic Funds Transfer (EFT): Enables the electronic transfer of funds between accounts.

These technologies focus on digitizing traditional banking services. They aim to make financial management more convenient and accessible.

Technologies In Fintech

Fintech involves innovative technologies to create new financial solutions. Key technologies in fintech include:

- Blockchain: Ensures secure and transparent transactions.

- Artificial Intelligence (AI): Provides insights through data analysis and automates processes.

- Machine Learning (ML): Improves decision-making and personalizes user experiences.

- Robo-Advisors: Offers automated investment advice and portfolio management.

- Peer-to-Peer (P2P) Lending Platforms: Connect borrowers directly with lenders.

These technologies aim to disrupt and innovate the financial industry. They introduce new ways to manage and invest money, often at lower costs and higher efficiency.

Application Areas

The difference between Digital Finance and Fintech can be clearer when looking at their application areas. Both fields have distinct yet sometimes overlapping uses. Knowing where each is applied can help in making informed decisions.

Digital Finance Applications

Digital Finance refers to the use of digital tools and services in traditional finance. It includes services offered by banks and financial institutions. These applications help in providing better customer service and efficient management.

Key areas where Digital Finance is applied:

- Online Banking: Customers can manage accounts and transactions online.

- Mobile Payments: Use of apps to transfer money or make payments.

- Digital Wallets: Store and manage money electronically.

- Personal Finance Management: Tools to track spending and budgeting.

- Fraud Detection: Systems to detect and prevent fraudulent activities.

Fintech Applications

Fintech (Financial Technology) is a broader term. It includes innovative technological solutions for financial services. Fintech covers new startups and technologies disrupting traditional finance. These applications often offer more flexible and accessible solutions.

Key areas where Fintech is applied:

- Peer-to-Peer Lending: Platforms that connect borrowers with lenders directly.

- Cryptocurrencies: Digital currencies like Bitcoin for transactions and investments.

- Robo-Advisors: Automated financial planning and investment services.

- Insurtech: Technologies used to simplify and improve the insurance industry.

- Regtech: Tools to help companies comply with regulations efficiently.

Market Impact

Understanding the market impact of digital finance and fintech is crucial. Both have reshaped the financial landscape, but their impacts differ significantly. This section explores how each influences the market.

Impact Of Digital Finance

Digital finance has streamlined financial services. It allows for easier access to banking and investment tools. This has led to increased financial inclusion globally.

With digital finance, transaction costs are lower. This benefits both consumers and businesses. Efficiency in transactions has improved, leading to faster and more secure financial operations.

Traditional banks have integrated digital finance solutions. This adoption helps them stay competitive. It also enhances customer satisfaction by providing more convenient services.

Global markets have become more interconnected. Digital finance facilitates cross-border transactions. This has expanded opportunities for trade and investment.

Impact Of Fintech

Fintech companies have introduced innovative solutions. These solutions challenge traditional financial institutions. They offer new ways to manage money, invest, and obtain loans.

Financial technology has democratized access to financial services. Small businesses and startups benefit from fintech. They gain access to funding and financial tools that were previously unavailable.

Consumer behavior is changing due to fintech. People prefer using fintech apps for financial tasks. This shift has forced traditional banks to innovate and improve their digital offerings.

Investment in fintech is growing rapidly. Venture capitalists and investors see the potential. This influx of capital drives further innovation and market expansion.

Regulatory challenges arise with fintech growth. Governments need to adapt regulations. Ensuring security and compliance is a continuous process.

Understanding these impacts helps in navigating the evolving financial landscape. Both digital finance and fintech play vital roles in shaping the future of finance.

Regulatory Environment

The regulatory environment shapes both digital finance and fintech. Understanding these regulations helps businesses navigate compliance and build trust. Both sectors face unique regulatory challenges and opportunities.

Regulations In Digital Finance

Digital finance encompasses traditional financial services delivered through digital channels. This sector must follow stringent regulations. These rules ensure consumer protection and financial stability. Governments and financial authorities oversee these regulations.

Regulatory bodies like the SEC and FCA play key roles. They enforce laws to prevent fraud and ensure transparency. Compliance with these regulations is mandatory. Digital finance firms invest heavily in legal and compliance teams. This investment ensures they meet regulatory standards.

Data privacy is a major concern in digital finance. Regulations like GDPR and CCPA govern data handling practices. Firms must secure customer data and provide clear privacy policies. Non-compliance can lead to severe penalties.

Regulations In Fintech

Fintech operates at the intersection of technology and finance. This sector often faces evolving regulations. Fintech companies must stay agile and adaptable. Regulatory sandboxes help fintech startups test new products with relaxed rules.

Many fintech firms focus on innovation. They develop new financial solutions, which can outpace existing regulations. Governments are working to keep up with rapid advancements. New laws are introduced to address emerging fintech trends.

Fintech firms must comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. These rules prevent illegal activities and protect consumers. Adherence to these regulations builds trust and credibility.

Cybersecurity is another critical area. Fintech firms must safeguard their platforms against cyber threats. Regulatory bodies demand robust cybersecurity measures. Compliance ensures the integrity and security of financial transactions.

Credit: www.researchgate.net

Future Trends

The future of digital finance and fintech promises exciting advancements. These sectors are evolving rapidly, driven by technology and changing consumer behaviors. Both fields aim to improve financial services, but they do so in different ways. Let’s explore the future trends in both digital finance and fintech.

Trends In Digital Finance

Digital finance is integrating more AI-based tools. These tools help in analyzing large datasets. AI improves decision-making and risk management. Blockchain technology is also gaining traction. It offers secure and transparent transactions. This tech reduces fraud and increases trust.

Another trend is mobile banking. More people are using mobile apps for financial services. This trend is growing in both urban and rural areas. Digital finance also focuses on personalized financial services. It tailors products to individual needs. This approach enhances customer satisfaction.

Trends In Fintech

Fintech is pushing the boundaries of innovation. One key trend is the rise of digital wallets. These wallets offer convenience and security. They are becoming more popular for online and offline transactions.

Robo-advisors are also on the rise. These automated platforms provide financial advice. They use algorithms to create investment plans. This makes financial planning accessible to more people.

Peer-to-peer lending is another growing trend. It connects borrowers directly with lenders. This model reduces the need for traditional banks. Fintech is also enhancing cybersecurity measures. Strong security is vital for protecting user data. New technologies aim to prevent cyber threats and fraud.

Challenges And Opportunities

The challenges and opportunities in digital finance and fintech is essential. These sectors offer numerous benefits but also come with their own set of hurdles. By examining the specific challenges and potential opportunities, we can get a clearer picture of what lies ahead.

Challenges In Digital Finance

Digital finance faces several significant challenges. Security is a major concern. Protecting sensitive financial data from cyber threats is critical. Regulatory compliance also presents difficulties. Digital finance platforms must adhere to various laws and regulations. This can be complex and time-consuming.

Another challenge is technology adoption. Not everyone is comfortable with digital platforms. This can limit the reach and effectiveness of digital finance solutions. Additionally, infrastructure can be a hurdle. In many regions, reliable internet and technology access are still lacking.

Challenges In Fintech

Fintech, although innovative, has its own set of challenges. Regulatory hurdles are a primary concern. Fintech companies must navigate a complex web of regulations. This can slow down innovation and increase costs.

Customer trust is another challenge. Many people are still wary of using new fintech solutions. Building and maintaining trust is crucial. Additionally, competition in the fintech space is fierce. Staying ahead requires constant innovation and adaptation.

Opportunities In Digital Finance

Despite the challenges, digital finance offers numerous opportunities. One major opportunity is financial inclusion. Digital finance can provide access to financial services for underserved populations. This can help reduce poverty and improve economic stability.

Digital finance also enables better data analysis. This can lead to more personalized financial services. Cost efficiency is a significant benefit. Digital platforms can reduce the costs associated with traditional financial services.

Opportunities In Fintech

Fintech presents several exciting opportunities. Innovation is at the forefront. Fintech allows for the development of new financial products and services. This can meet the evolving needs of consumers.

Fintech can also enhance financial literacy. By making financial services more accessible, people can learn and manage their finances better. Furthermore, fintech can improve operational efficiency. Automated processes can save time and reduce errors, benefiting both businesses and consumers.

Credit: www.paymentsjournal.com

Frequently Asked Questions

What Is Digital Finance?

Digital finance involves managing financial services through digital platforms. It includes online banking, digital payments, and mobile wallets.

How Does Fintech Differ From Digital Finance?

Fintech refers to technology-driven financial innovations. Digital finance is the broader application, while fintech focuses on developing new tools and solutions.

Can Fintech Improve Digital Finance Services?

Yes, fintech enhances digital finance by introducing advanced technologies. These include AI, blockchain, and data analytics to improve efficiency and user experience.

Is Digital Finance Safe?

Digital finance uses robust security measures. These include encryption and multi-factor authentication to protect users’ financial information.

Conclusion

Digital finance and fintech have distinct roles in our modern world. Digital finance refers to managing money online. Fintech, on the other hand, combines technology with financial services. Both fields are important. They improve how we handle money. Understanding their differences helps make better choices.

Keep learning about these areas. Stay informed and adapt to new trends. This knowledge can benefit your financial decisions.