TaxCycle Tax Software Review TaxCycle is a professional tax software designed for accountants and bookkeepers. It simplifies tax compliance and offers a range of features to enhance efficiency.

TaxCycle stands out in the market with its robust tools and intuitive interface. Accountants and bookkeepers benefit from reduced data entry, electronic signatures, and a client portal. The software also supports various workflows and integrates with Xero for seamless data import. TaxCycle’s audit and review tools ensure accuracy, while its customizable options cater to different office sizes. With a satisfaction guarantee and free support during tax season, TaxCycle aims to meet the needs of tax professionals. For more details, visit the TaxCycle website or explore the product further here.

Introduction To Taxcycle Tax Software

TaxCycle is a professional tax software designed for accountants and bookkeepers. It simplifies tax compliance, reduces data entry time, and enhances accuracy.

Overview Of Taxcycle And Its Purpose

TaxCycle offers a range of features to streamline tax preparation:

- Reduced Data Entry: Carryforward conversions, Auto-fill my return (AFR), Smart copy/paste, Corporate linking, Excel import, SlipSync.

- Essential Tools: Electronic signatures, client portal, EFILE, Data Mining, DoxCycle, Client Manager, Template Editor, customizable workflow.

- Audit and Review Tools: Alerts for potential issues, Quick Fix solutions, manage multiple reviewers.

- Intuitive Form and Field Search: Keyword and form searches, F4 Fast Find, Ctrl+F for form search.

- Familiar Forms and Shortcuts: Keyboard shortcuts, forms-based screens for data entry.

- Options for Everyone: Configurable status items, workflow tools, custom reports.

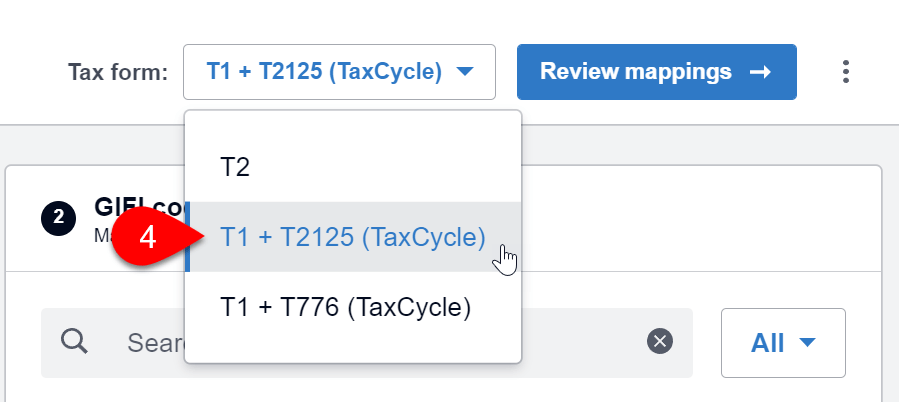

- Integration with Xero: Import GIFI data from Xero into T1, T2, T5013 returns.

Target Audience And Market Position

TaxCycle is designed for professional accountants and bookkeepers. It aims to simplify tax compliance and improve efficiency for both small and large offices.

With its extensive features, TaxCycle stands out in the market as a comprehensive solution for tax professionals. It offers customizable options and integrates with Xero, making it a valuable tool for offices of any size.

Pricing Details

| Product | Price | Additional Users |

|---|---|---|

| Complete Tax Suite 2024 | $2,490 | $700 each |

| Complete Tax Suite + TaxFolder 2024 | $2,839 | $899 each |

| Tax Basics 2024 | $1,490 | $500 each |

TaxCycle offers a satisfaction guarantee. If you are unhappy, they will fix the issue or refund your money in full. Personal tax calculations made through the software are covered by a T1/TP1 accuracy guarantee.

Contact Information

If you need support, contact TaxCycle via:

- Phone: 1-888-841-3040

- Email: info@taxcycle.com

- Address: 800 – 1333 8 ST SW, Calgary, AB T2R 1M6, Canada

Free support is available six days a week during tax season. You can also schedule a live demo with a TaxCycle expert.

Credit: www.youtube.com

Key Features Of Taxcycle

TaxCycle stands out as a top choice for accountants. It simplifies tax compliance with unique features. This software is designed to enhance efficiency and accuracy during tax filing. From user-friendly navigation to integration capabilities, TaxCycle offers a comprehensive experience. Let’s dive into the main features that make TaxCycle an essential tool.

User-friendly Interface And Navigation

TaxCycle boasts an intuitive interface that ensures smooth navigation. The software uses forms-based screens for data entry. This familiar setup reduces the learning curve for new users. Quick access to forms with keyboard shortcuts improves productivity. Its intuitive form and field search functions aid in swift data location. Keyword searches and shortcuts like F4 and Ctrl+F make searches faster.

Comprehensive Tax Filing Options

TaxCycle offers a range of tax filing options to meet diverse needs. It supports carryforward conversions and auto-fill features. Users benefit from corporate linking and Excel import for data accuracy. SlipSync technology streamlines data entry by syncing slips. Electronic signatures and EFILE streamline client interactions. TaxCycle enhances workflow with customizable templates and data mining capabilities.

Real-time Collaboration Tools

TaxCycle provides robust tools for real-time collaboration. Alerts for potential issues ensure smooth team communication. Quick Fix solutions tackle problems swiftly. Multiple reviewers can manage projects simultaneously, enhancing team efficiency. The client portal facilitates document sharing with clients. This feature ensures seamless interaction and document exchange.

Integration With Accounting Software

TaxCycle integrates seamlessly with Xero accounting software. It allows importing GIFI data directly into tax returns. This integration supports T1, T2, and T5013 returns. Users benefit from the free Xero Partner Program account. Shared pricing benefits enhance affordability for firms. TaxCycle’s integration capabilities streamline data management.

Pricing And Affordability

Choosing the right tax software involves considering both features and cost-effectiveness. TaxCycle offers professional-grade tools tailored for accountants and bookkeepers. Understanding its pricing structure is crucial to evaluate its affordability and value.

Breakdown Of Pricing Tiers

| Package | Price | Additional User Cost |

|---|---|---|

| Complete Tax Suite 2024 | $2,490 | $700 each |

| Complete Tax Suite + TaxFolder 2024 | $2,839 | $899 each |

| Tax Basics 2024 | $1,490 | $500 each |

TaxCycle offers different pricing tiers to suit varied needs. The Complete Tax Suite provides comprehensive tools at $2,490. Adding TaxFolder increases the total to $2,839. For smaller operations, the Tax Basics package is $1,490.

Value For Money Assessment

Assessing TaxCycle’s pricing involves looking at its features and benefits. The software simplifies tax compliance and reduces data entry time. Audit tools enhance accuracy, making it a valuable investment for professionals. The inclusion of electronic signatures and client portals streamlines workflow, increasing efficiency.

- Offers reduced data entry with features like Carryforward conversions and SlipSync.

- Supports workflow management with customizable templates and reports.

- Integrates with Xero for seamless data import.

Given these features, the pricing reflects significant value for large and small offices alike. Additionally, the satisfaction guarantee and accuracy assurance provide peace of mind.

Credit: www.taxcycle.com

Pros And Cons Of Taxcycle

TaxCycle is a popular tax software for accountants and bookkeepers. It simplifies tax compliance and enhances efficiency. This section explores the advantages and potential drawbacks based on user feedback. The insights will help you decide if TaxCycle suits your needs.

Advantages Based On User Feedback

Users appreciate TaxCycle’s reduced data entry features. The carryforward conversions and Auto-fill my return save time. Smart copy/paste and SlipSync further streamline processes. TaxCycle integrates well with Xero, importing GIFI data efficiently.

- Electronic Signatures: Users highlight the convenience of electronic signatures.

- Client Portal: The portal enhances client communication and document sharing.

- Audit Tools: Alerts and Quick Fix solutions improve accuracy.

- Customizable Workflow: Users can tailor the workflow to fit their office needs.

The software includes familiar forms and shortcuts, which users find intuitive. The customizable status items and workflow tools cater to both large and small offices.

Potential Drawbacks And Limitations

Some users mention the pricing as a limitation. The Complete Tax Suite costs $2,490, with additional fees for extra users. This might be steep for smaller offices.

Despite the satisfaction guarantee, certain users feel the refund process could be quicker. The need for improved speed is echoed in feedback regarding form searches. While TaxCycle provides fast find options, some users find them less responsive.

The software’s complexity can be a learning curve for new users. Though it offers free support, mastering all features might take time.

Overall, TaxCycle is praised for its functionality but has areas needing improvement.

Ideal Users And Scenarios

TaxCycle is a professional tax software designed for accountants and bookkeepers. It simplifies tax compliance and offers a comprehensive suite of tools. This makes it ideal for various users and scenarios. Below, we explore how TaxCycle fits into different user needs and business contexts.

Best Fit For Small Businesses

Small businesses often need efficient tax solutions that save time and reduce costs. TaxCycle provides essential tools like electronic signatures and a client portal. These features streamline workflows and enhance productivity. The software’s reduced data entry through options like Auto-fill my return (AFR) and Excel import minimizes manual work.

Small businesses benefit from the customizable workflow tools and reports. These features allow them to tailor the software to their specific needs. The integration with Xero is an added advantage, allowing seamless import of GIFI data.

| Feature | Benefit for Small Businesses |

|---|---|

| Electronic Signatures | Streamlines document processes |

| Client Portal | Enhances client communication |

| Auto-fill my return (AFR) | Reduces data entry time |

| Customizable Workflow | Adapts to business needs |

| Xero Integration | Simplifies GIFI data import |

Suitability For Tax Professionals

Tax professionals require robust tools for efficient tax preparation and audit reviews. TaxCycle offers audit and review tools like alerts for potential issues and Quick Fix solutions. These features enhance accuracy and efficiency in handling complex tax scenarios.

The software supports multiple users with its Complete Tax Suite, which is ideal for larger teams. The intuitive form and field search functions aid in quick navigation and data retrieval. This ensures that tax professionals can work swiftly and accurately.

- Audit Tools: Alerts and Quick Fix solutions for enhanced accuracy.

- Multi-User Support: Suitable for larger teams with its Complete Tax Suite.

- Form Search: F4 Fast Find and Ctrl+F for easy data access.

- Client Manager: Manages client data efficiently.

With a satisfaction guarantee and free support available, TaxCycle provides peace of mind to tax professionals. It’s a reliable choice for those who need comprehensive features and dependable service.

Credit: www.linkedin.com

Frequently Asked Questions

What Tax Software Do Most Cpa Firms Use?

Most CPA firms use tax software like Intuit ProConnect, Drake Tax, UltraTax CS, and Lacerte. These tools streamline tax preparation, ensure compliance, and offer robust features for professionals. Selecting the right software depends on firm size, budget, and specific needs.

What Is The Best Tax Software To Do Your Own Taxes?

TurboTax is popular for its user-friendly interface and comprehensive features. H&R Block offers solid customer support and affordability. TaxAct is a budget-friendly option with essential tools. Choose based on specific needs, such as complexity of taxes or budget constraints.

Is It Safe To Use Online Tax Software?

Online tax software is generally safe when using reputable providers. They offer encryption and secure data storage. Ensure the software is regularly updated and has strong customer reviews. Always use strong, unique passwords and enable two-factor authentication for added security.

Check for a secure connection (https) before entering sensitive information.

Is Lacerte A Good Tax Software?

Lacerte is a reliable tax software favored by professionals for its comprehensive features and user-friendly interface. It handles complex tax scenarios efficiently, offering robust support and updates. Many users appreciate its accuracy and ease of use, making it a popular choice for tax preparation.

Conclusion

TaxCycle offers streamlined tax solutions for accountants and bookkeepers. Its tools reduce data entry and enhance accuracy. Workflow efficiency improves with features like electronic signatures and client portals. TaxCycle’s customizable options suit both small and large offices. Integration with Xero provides added value. For more details, visit the TaxCycle website.